Solutions

Payroll in France

Thinking about hiring in France? To stay compliant and keep things running smoothly, you’ll need to understand the local rules around HR, payroll, social security, and taxes. Discover the key information laid out for you below.

HR and labor laws in France

When you’re hiring in France, it’s crucial to understand local labor laws. From contracts and working hours to leave entitlements and dismissal procedures, here’s what you should know about specific laws in France.

Employment contracts

France offers several types of employment contracts, including the CDI (permanent contract) and CDD (fixed-term contract).

Social security in France

The social security system in France acts as a safety net for your employees, offering protection in key moments throughout their careers and lives. It’s designed to provide financial support during live events like illness, maternity, unemployment or retirement. Discover how the social security system works in France:

Workplace protections

Creating a fair and safe workplace matters. These laws help protect your employees in France:

Tax regulations in France

Taxes can be tricky. Understanding how the system works in France, helps you avoid surprises and stay compliant. Here are some tax basics to keep in mind:

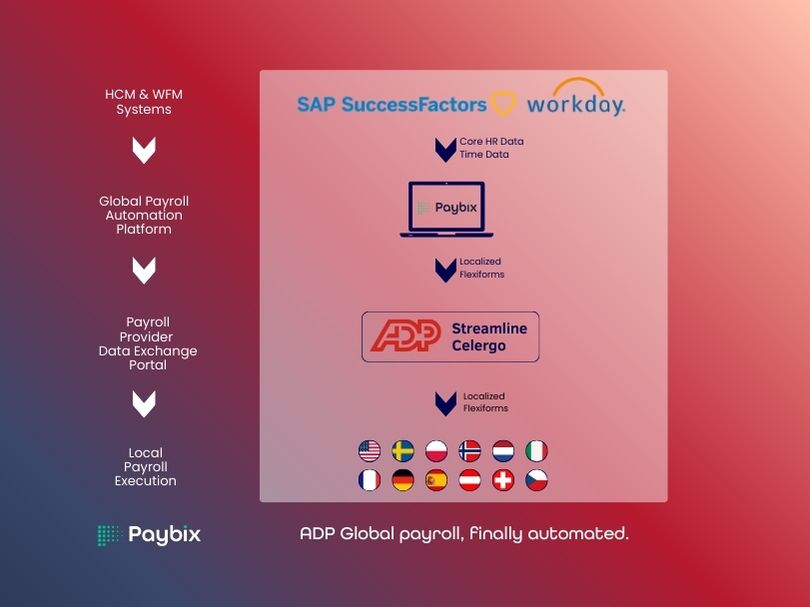

Paybix helps you managing your payroll in France

Running European payroll, EMEA payroll and global payroll takes local knowhow. With Paybix, you’ll get expert support, tailored to each country your business in situated in. Thanks to our unified and digital platform, you gather clear insight in labor costs and cross-country payroll. You benefit from a 30% more efficient payroll process, including global reporting and core HR data management. Hassle-free, user-friendly and easy integrated with local payroll providers in Belgium, Spain, the United Kingdom and many more.

To ensurefull compliance with the latest regulations, Paybix consults with local legal partners and payroll providers. Get in touch with our experts. We provide you with accurate and up-to-date information.

Ready to optimize your payroll processes? Contact us. Book your free and personalised demo. Discover our data-driven solutions for your business success.

Become a partner

Become a Paybix partner and expand your business without major investment.

Want to schedule a demo?

Get an in-depth look into all our features.

.png)