Solutions

The Payroll Odyssey: Rudi De Roeck’s Journey in International Payroll & Outsourcing

From Payroll Enthusiast to Payroll Expert

Hello, my name is Rudi De Roeck, and I have a confession to make: I am a self-proclaimed payroll addict. My journey into the world of international payroll began 40 years ago when I took my first job at SD Worx, a leading international payroll provider. This is where I built my expertise and helped put international payroll outsourcing on the map.

Climbing the Payroll Ladder

Fast forward 20 years, and I took on the role of European Head of HR Systems at Coca-Cola Enterprises. Determined to expand my expertise, I then spent three years as a Principal Advisor for HR and Payroll Outsourcing at Equaterra, later acquired by KPMG.

Venturing Out as an Independent Payroll Advisor

Between 2011 and 2021, I worked independently as an HR and Payroll sourcing advisor, guiding Fortune 500 companies such as Allianz, Astra Zeneca, Bridgestone, Chevron, Lufthansa, Nokia, Rio Tinto, and Siemens through the complexities of global payroll compliance and optimisation.

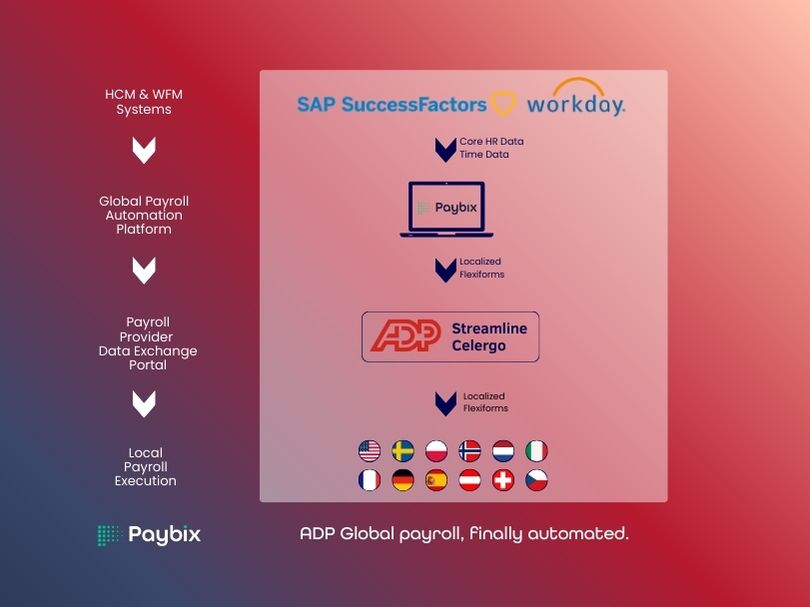

The Birth of Paybix: A New Payroll Aggregation Solution

In 2021, I co-founded Paybix, an international payroll aggregation SaaS solution designed for European SMEs. Together with my co-founders, we built a scalable, tech-driven payroll solution that partners with in-country payroll providers (ICPs) to deliver harmonised, end-to-end payroll services in 40 European countries.

The "One-Size-Fits-All" Payroll Myth

Over the years, I have seen countless companies struggle with payroll challenges. One of the biggest misconceptions is the idea of a "one-size-fits-all" global payroll solution. Let me explain why this approach doesn’t work:

1. Technology Challenges in Payroll Management

While SAP is often regarded as the only truly global payroll software, it was designed for large multinational corporations, not SMEs. Imposing SAP on small and medium entities within a global firm can result in operational inefficiencies and complex workflows that payroll professionals struggle to navigate.

2. Service Delivery Pitfalls of Global Payroll BPOs

Global Payroll BPO providers focus on scalability to deliver payroll services at lower costs. However, their standardised approach does not work well for small-volume countries. These markets require a white-glove service, which large BPO providers often fail to deliver.

3. Communication and Expertise Barriers

In many cases, your primary contact at a payroll provider is in an international hub, far removed from the actual in-country payroll experts. This leads to slow responses, misunderstandings, and potential compliance risks.

4. The High Cost of Payroll Implementation

Implementing a global payroll software for each country is expensive. Costs can range from $20,000 to $50,000 in setup fees per country, plus an annual maintenance fee of $5,000 to $25,000. For SMEs, these costs are prohibitive, often leading them to delay payroll modernisation, which can cause compliance risks down the line.

Why Payroll Innovation Matters for SMEs

Many companies hesitate to upgrade payroll solutions, following the old adage: "If it’s not broken, don’t fix it." However, this mindset can lead to end-of-lifecycle panic, where businesses rush into costly last-minute solutions. Payroll automation and modernisation can bring several benefits:

- Cost Savings: Even if the initial cost per employee is higher, automated payroll solutions eliminate inefficiencies and save money in the long run.

- Regulatory Compliance: Up-to-date solutions ensure 100% compliance with local labour laws and tax regulations.

- Efficiency & Accuracy: Payroll professionals can reduce errors, improve processing speed, and enhance reporting capabilities.

The Key Players in International Payroll

The global payroll landscape is dominated by three major groups:

1. Global Payroll BPOs

These include ADP and Strada, which use SAP-based platforms like Global View and euHReka. While powerful, these solutions cater to large enterprises with 15,000+ employees, making them unsuitable for SMEs.

2. US & Asia-Centric Payroll BPOs Expanding into Europe

Companies like Dayforce, UKG, Neeyamo, and Ramco are aggressively expanding into Europe, the Middle East, and Africa (EMEA), focusing on large and mid-sized enterprises.

3. Payroll Aggregators

Payroll aggregators focus on international payroll data integration, collecting and processing payroll information via local providers (ICPs). The key players include CloudPay, Safeguard, and TMF Group, but most still target businesses with 5,000+ employees.

The Untapped Potential of Small & Midsize International Companies

The SME payroll market remains largely underserved. This is where Paybix steps in. We focus on small and midsize enterprises, offering an affordable and scalable payroll aggregation platform that minimizes human errors, automates compliance, and streamlines international payroll processing.

Final Thoughts: Rudi’s Payroll Wisdom

After 40years in the industry, I leave you with these key takeaways:

- Payroll is not a one-size-fits-all service. Leverage expert local payroll providers to unlock potential cost savings and navigate complex local payroll legislation.

- Collaborate with your payroll provider to ensure 100% accuracy, compliance, and timeliness.

- Test the motto: "Global or regional where you can, local where you must."

Payroll is evolving, and SMEs can no longer afford to rely on outdated solutions. If you’re ready to modernise your payroll strategy, let’s talk.

🚀 Ready to Transform Your Payroll?

👉 Schedule a demo with Paybix today and discover how our payroll aggregation SaaS can streamline your international payroll operations.

Download our PDF

Watch the webinar

Schedule a demo with one of our experts.

Get an in-depth look into all our features.

.jpg)

.png)